By 2028, the average professional will have optimized their morning routine, their sleep architecture, their cortisol levels—and remain fundamentally bankrupt in the currency that matters most.

Think about that. We track our steps, our REM cycles, our deep work hours. We build dashboards for productivity and portfolios for wealth. The quantified self has become the commodified self—every waking moment converted into observable, comparable, flex-worthy metrics.

The unobservable? It doesn't trend.

We evolved for small-group recognition, not global metrics. The human mind—shaped over millennia for faces we knew and reputations that traveled by word of mouth—now confronts an infinite scroll of comparison.

The result is not adaptation but anxiety.

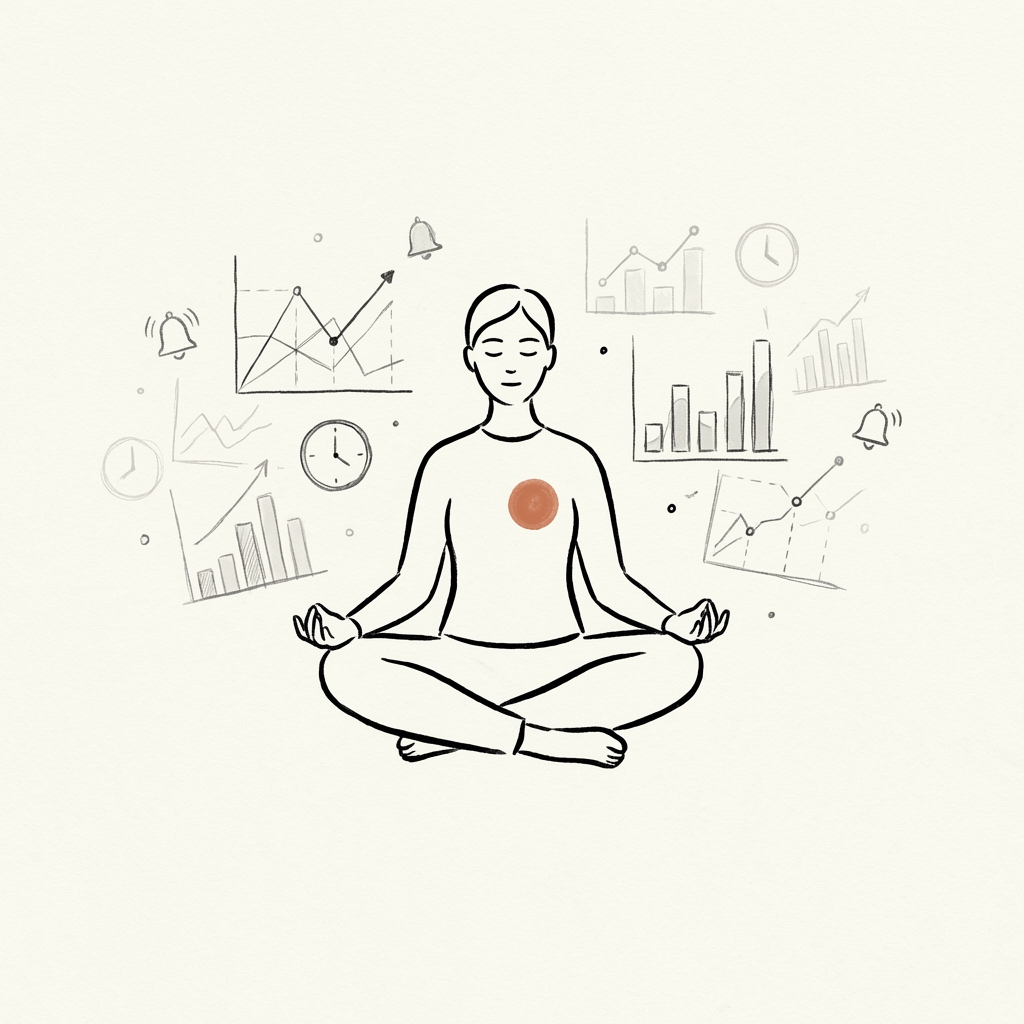

We optimize for what we can screenshot, what we can quantify, what we can compare. But here's the arbitrage opportunity: the market systematically misprices inner peace. We treat it as a luxury good, something to purchase after success. The Stoics—and later, the monks—understood it as the underlying asset against which everything else is derivative.

They diversified not across status symbols, but across attachments.

The accounting is brutal. Every hour spent curating visibility is stolen from invisibility. Every calorie of attention burned on personal branding is a calorie not spent on presence, depth, or the slow accumulation of what cannot be displayed.

You cannot flex your inner peace.

This is precisely why it's undervalued—and precisely why it's the trade of a lifetime.

Financial markets teach us to buy when others panic. The same logic applies to the interior.

Crisis reveals what boom conceals. When the external portfolio crashes—job loss, relationship collapse, health scare—the internal portfolio either sustains you or it doesn't. Most people discover their insolvency too late.

The dip is the test.

Most fail it.

We avoid stillness not because it's worthless, but because its returns are invisible in bull markets. Peace appreciates when everything else depreciates. It offers convexity in crisis—unlimited upside, limited downside. Yet we consistently overweight the visible and underweight the resilient.

Your meditation app tracks your streaks. Your sleep tracker graphs your REM. Your biohacking routine produces spreadsheets of optimization.

The peace itself?

Unlogged. Unliked. Unseen.

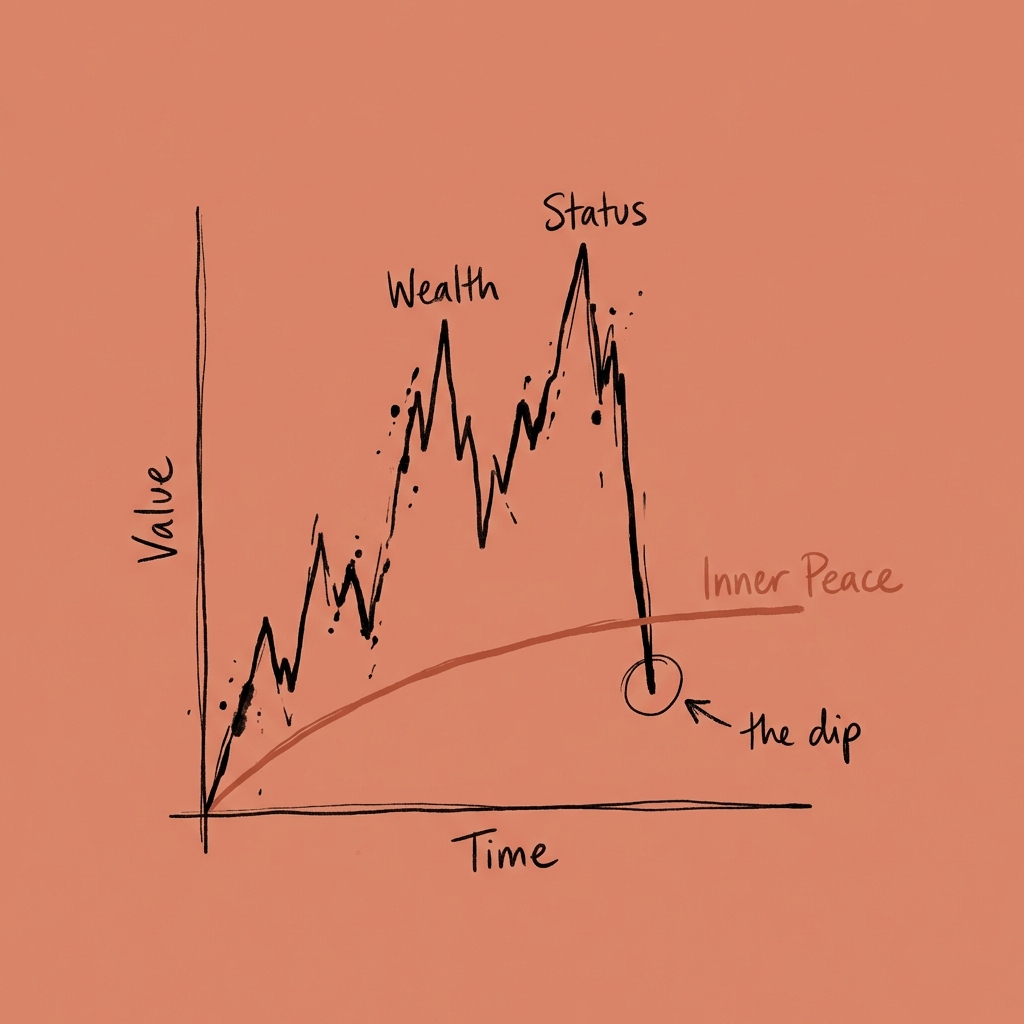

This isn't about retreating from the world. It's about refusing to let the world colonize your interior.

The strategy is simple: dollar-cost average into stillness. Small, consistent allocations to silence, solitude, slowness. You buy when it's uncomfortable. You buy when it's unpopular. You buy when every signal says sell—when the market is euphoric for hustle, for visibility, for more.

Inner peace—the capacity to remain undisturbed regardless of external conditions—compounds in ways follower counts never will.

It is the ultimate counter-cyclical asset.

The evolutionary mismatch is stark. We are dopaminergic creatures built for pursuit, not presence. The infinite feed exploits this. It offers the simulation of progress while extracting the reality of peace.

The body remembers.

The nervous system, evolved over millions of years, knows the difference between the simulated and the real, the flexed and the felt.

The ROI of inner peace isn't measured in returns—it's measured in avoided losses:

Wealth without peace is a high-beta stock—volatility without resilience. Status without depth is inflationary currency, printing faster than it compounds.

The loneliness epidemic of the 2020s wasn't met with community-building but with companionship commodification. AI companions, algorithmic feeds, synthetic sociality.

They never disappoint you. They never grow apart. They never die.

They also never truly see you.

The presence paradox defines this era: unprecedented connectivity producing unprecedented isolation. We tried the infinite and found it empty.

By 2028, we'll have learned what the data couldn't tell us—that the finite, the particular, the real, outperforms the infinite, the abstract, the synthetic.

We're not retreating to monasteries. We're reallocating. Recognizing that inner peace isn't a consumption good but a productive asset. That the unobservable metrics—depth of friendship, quality of attention, capacity for silence—have the highest risk-adjusted returns in a volatile world.

The market will continue mispricing peace.

That's the opportunity.

We built portfolios of visibility. They hollowed us.

We're learning to accumulate what cannot be displayed. And in that accumulation, we're finding what the observable could never give: the capacity to remain ourselves, regardless of the market.

Buy the dip.